An unfortunate side-effect of the UK leaving the European Union is that since then, some of you may have faced some surprise, rather unwelcome customs clearance and import fees when your goods were delivered.

An unfortunate side-effect of the UK leaving the European Union is that since then, some of you may have faced some surprise, rather unwelcome customs clearance and import fees when your goods were delivered.

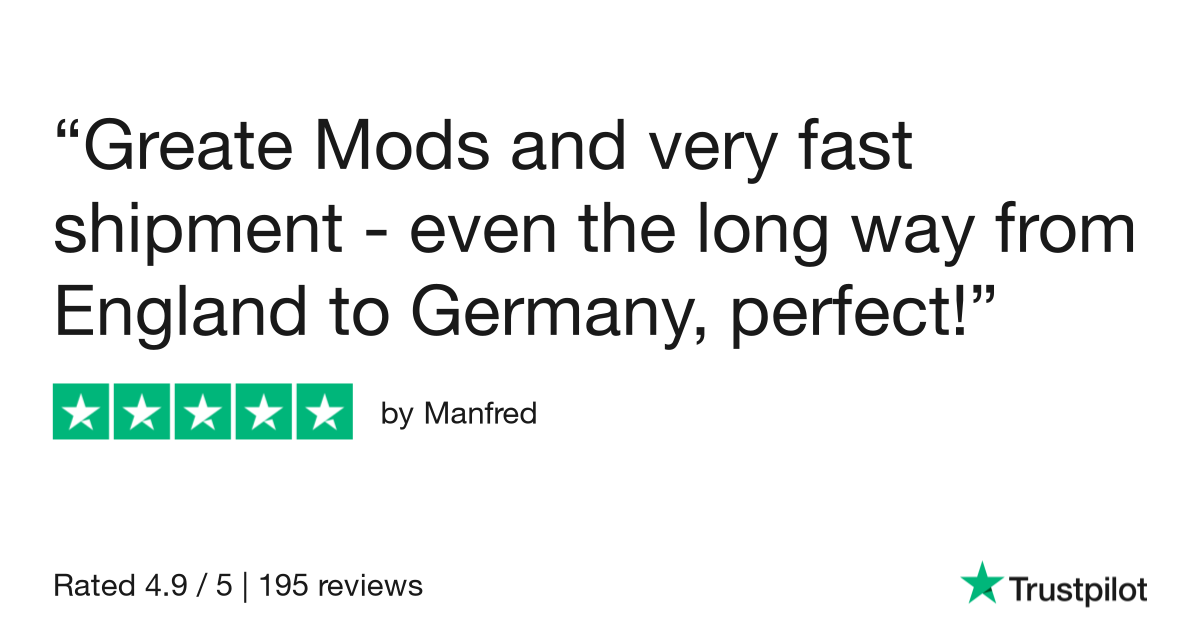

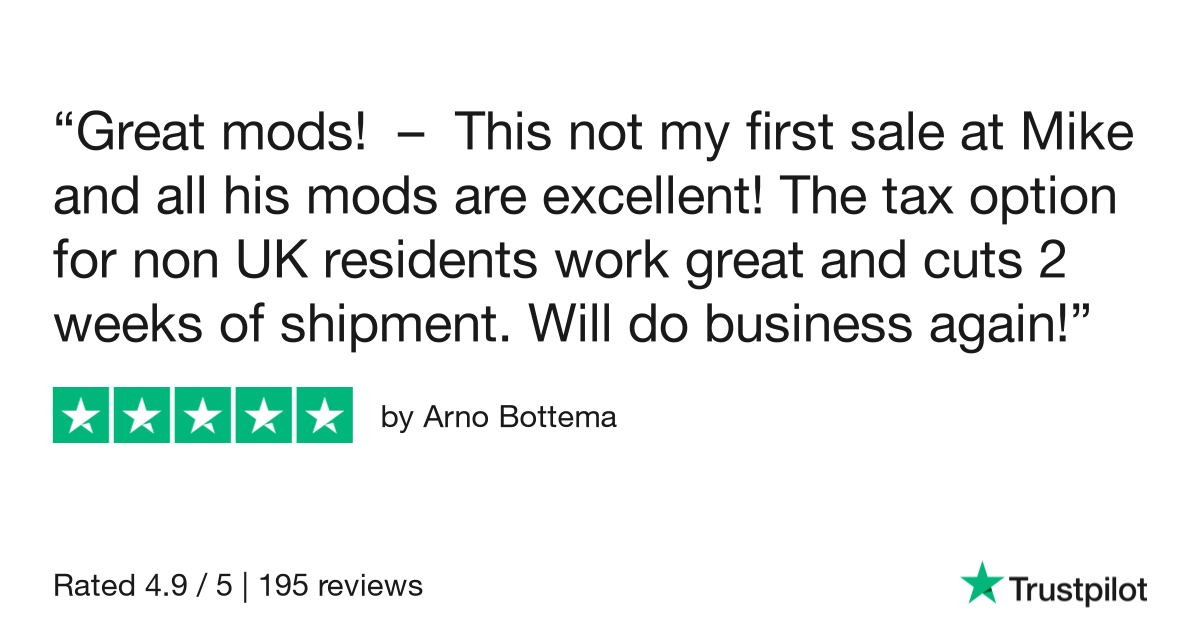

I hear you loud and clear – import fees and duties suck! They are never a welcome surprise. The good news is that Mike Lane Mods is now part of the Import One-Stop-Shop (IOSS) scheme.

What does this mean? Being part of the IOSS means that Import VAT will now be exempt for EU customers with orders valued below €150 – meaning faster clearance at customs and no more surprise duties to pay when your goods arrive. You’ll only be charged VAT at checkout when you place your order. And, to make things as easy as possible, my website will inform you at checkout if your order qualifies for IOSS or not. Simple.

I hope this comes as good news and helps to make modding your model that little bit easier and more affordable.

I hear you loud and clear – import fees and duties suck! They are never a welcome surprise. The good news is that Mike Lane Mods is now part of the Import One-Stop-Shop (IOSS) scheme.

What does this mean? Being part of the IOSS means that Import VAT will now be exempt for EU customers with orders valued below €150 – meaning faster clearance at customs and no more surprise duties to pay when your goods arrive. You’ll only be charged VAT at checkout when you place your order. And, to make things as easy as possible, my website will inform you at checkout if your order qualifies for IOSS or not. Simple.

I hope this comes as good news and helps to make modding your model that little bit easier and more affordable.

FAQ’s

When should I expect to pay VAT and import duties?

Orders valued below €150 – VAT at checkout. No Import Duty.

Orders valued above €150 – VAT on arrival. Possible Import Duty.

What happens if my order is valued over €150?

Orders valued over €150 fall outside of the EU IOSS scheme and will be processed as per normal at customs. This is nothing to worry about. This just means that rather than paying VAT at checkout, you will instead be responsible for paying the Import VAT and possibly customs clearance fees when your order arrives in your country – in the same way that trade with the USA and other non-EU countries works. The carrier will handle this for you and will contact you directly via e-mail or text message to collect payment before the parcel is delivered. The cost of these fees will vary depending on the value of your order and the country it is being sent to.

Is VAT due on all imports?

Yes, as of 1 July 2021 the EU ended its low-value consignment relief threshold of €22, which means all products going into the EU will attract VAT either at checkout for orders valued below €150 or on arrival for orders over €150.

I live outside of the EU, does this affect me?

No. The IOSS scheme is specific to countries within the European Union. For all non-EU customers you will be responsible for paying taxes and possibly customs clearance fees as per normal when your order arrives in your country. The carrier will handle this and will contact you directly via e-mail or text message to collect payment before the parcel is delivered. The cost of these fees will vary depending on the value of your order and the country it is being sent to.

FAQ’s

When should I expect to pay VAT and import duties?

Orders valued below €150 – VAT at checkout. No Import Duty.

Orders valued above €150 – VAT on arrival. Possible Import Duty.

What happens if my order is valued over €150?

Orders valued over €150 fall outside of the EU IOSS scheme and will be processed as per normal at customs. This is nothing to worry about. This just means that rather than paying VAT at checkout, you will instead be responsible for paying the Import VAT and possibly customs clearance fees when your order arrives in your country – in the same way that trade with the USA and other non-EU countries works. The carrier will handle this for you and will contact you directly via e-mail or text message to collect payment before the parcel is delivered. The cost of these fees will vary depending on the value of your order and the country it is being sent to.

Is VAT due on all imports?

Yes, as of 1 July 2021 the EU ended its low-value consignment relief threshold of €22, which means all products going into the EU will attract VAT either at checkout for orders valued below €150 or on arrival for orders over €150.

I live outside of the EU, does this affect me?

No. The IOSS scheme is specific to countries within the European Union. For all non-EU customers you will be responsible for paying taxes and possibly customs clearance fees as per normal when your order arrives in your country. The carrier will handle this and will contact you directly via e-mail or text message to collect payment before the parcel is delivered. The cost of these fees will vary depending on the value of your order and the country it is being sent to.

2 Replies on 🇪🇺 Good news for my European Union customers – No more surprise import fees on orders below €150

Leave a Reply Cancel reply

You must be logged in to post a comment.

What is happening with the “ Eleanor Gone in 60 Seconds Mustang “ I understand they have gone bust but not in sixty seconds what happens to our pre paid orders

Now available through Fanhome 👍